Compute the fixed overhead spending volume variance. Actual annual overhead costs totaled 800000 of which 294700 is fixed overhead.

Compute And Evaluate Overhead Variances Principles Of Accounting Volume 2 Managerial Accounting

Actual output x Standard variable overhead rate Actual variable overhead.

. To calculate the proportion of overhead costs compared to sales divide the monthly overhead cost by monthly sales and multiply by 100. Compute the variable overhead spending and efficiency variances. The overhead rate is determined by calculating how much indirect overhead is spent to produce products or services.

The variable overhead spending variance VOSV measures the aggregate effect of differences in the actual variable overhead rate and the standard. Compute price and usage variances for direct materials. 1000 Adverse a Expenditure Variance.

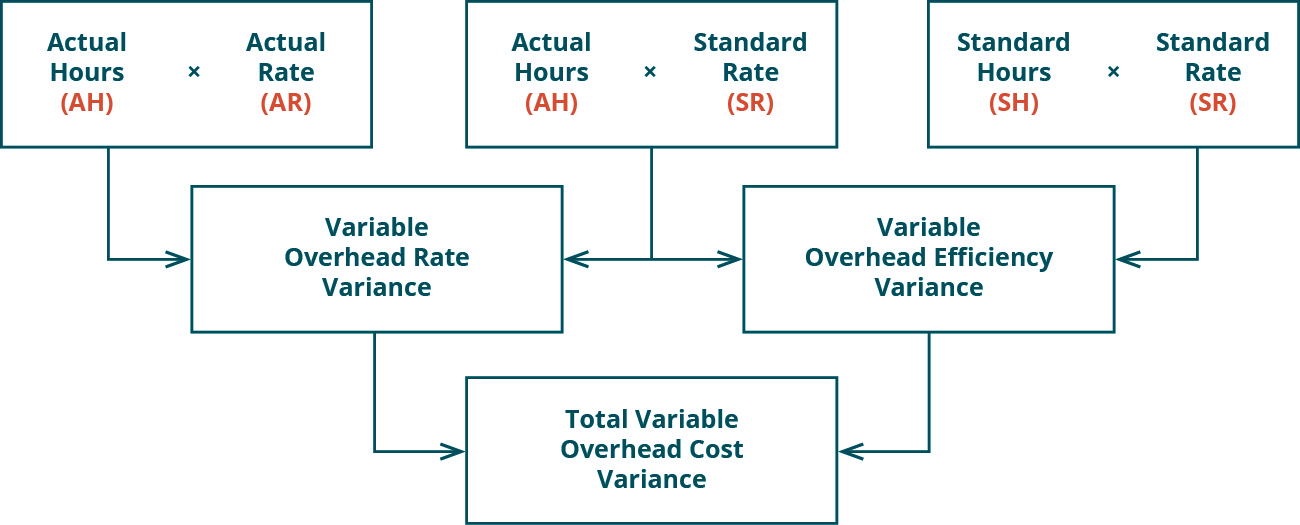

As mentioned above materials labor and variable overhead consist of price and quantityefficiency variances. If the overhead is underapplied add the amount of variance to each of the accounts. When calculating for variances the simplest way is to.

Compute the direct labor rate and labor efficient 3. The Column Method for Variance Analysis. 600 Adverse ii Fixed Overhead Variance.

Calculate the percentage of total applied overhead in each of the accounts. I Variable Overhead Variance. PriceRate Variances or differences between industry standard costs and actual pricing for materials.

VFOH Spending Variance and VFOH Efficiency Variance. If the overhead is overapplied add the amount of variance to each of the accounts. Learn variance analysis step by step in CFIs Budgeting and Forecasting course.

Companies use variance analysis in different ways. The variable overhead spending variance is the difference between the actual and budgeted rates of spending on variable overhead. Then use that percentage to calculate the amount of the variance that should be allocated to each account.

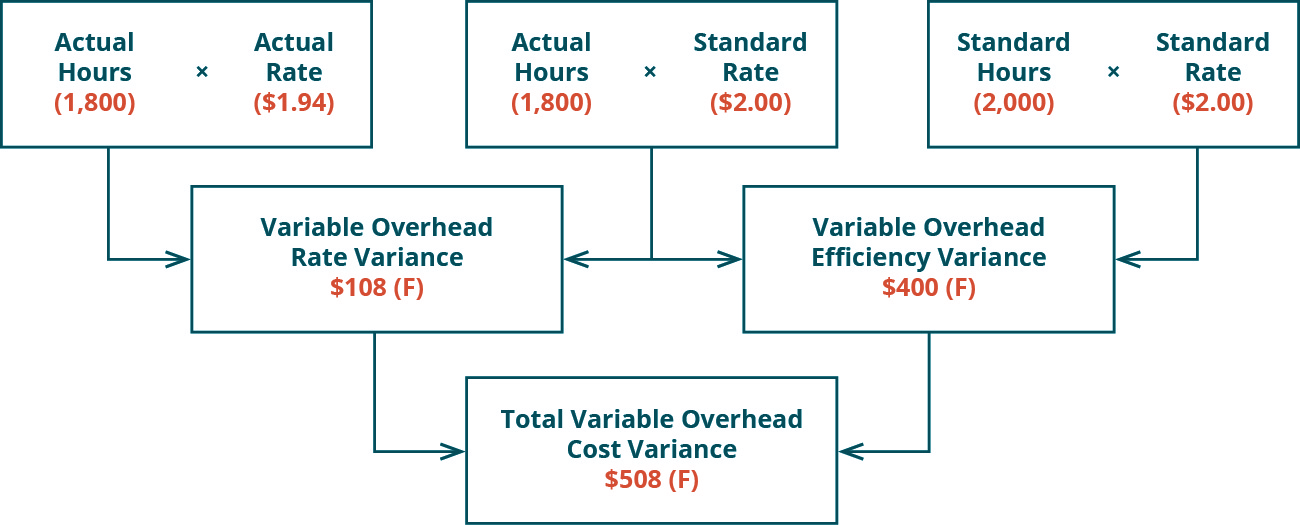

Since it takes one-half hour of machine time to make a pair of Blazing Feet the overhead burden rate is 18 per pair 12 X 36. Actual Quantity x Actual Rate. In this case two elements are contributing to the favorable outcome.

Below are some of the Variance Analysis formulae that one can apply. In job-order costing Job Order Costing Guide Job Order Costing is used to allocate costs based on a specific job order. Learn how to calculate it plus see examples.

Materials Labor and Variable Overhead Variances which include. Alternatively if the denominator is not in dollars then the overhead rate. The variable overhead rate variance is calculated as 1800 194 1800 200 108 or 108 favorable.

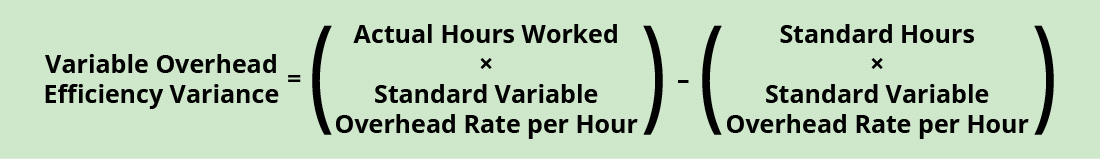

The result is an overhead rate of 20. The three-way analysis computes three variances spending efficiency and volume variances. Actual hours worked x Actual overhead rate - standard overhead rate Variable overhead spending variance.

49 Describe How Companies Use Variance Analysis. Calculate the fixed overhead spending and volume variances. The starting point is the determination of standards against which to compare actual results.

Activity-based costing is a more specific way of allocating overhead costs based on activities that actually contribute to overhead costs. For example a business with monthly sales of 100000 and overhead costs totaling 40000 has 40000 100000 x 100 40 overheads. VFOH spending variance and VFOH efficiency variance.

Many companies produce variance reports and the management responsible for the variances must explain any variances outside of a certain range. Actual output x Standard fixed overhead rate Actual fixed overhead. ABC incurs 50000 of direct labor costs so the overhead rate is calculated as.

Explain the meaning of the volume variance to the manager of Laughlin. VFOH efficiency variance Actual hours -. Efficiency Variances and Quantity Variances or differences between actual input values and the input amounts specified.

VFOH spending variance Actual rate - Standard rate x Actual hours. Therefore i Spending variance Variable spending variance Fixed spending budget variance ii Efficiency variance Variable efficiency variance iii Volume variance Fixed volume variance C Four-way Variance Analysis. Many companies produce variance reports and the management responsible for the variances.

100000 Indirect costs 50000 Direct labor. The variable overhead efficiency variance is calculated as 1800 200 2000 200 400 or 400 favorable. This guide will provide the job order costing formula and how to calculate it.

Fixed overhead however includes a volume variance and a budget variance. Variable factory overhead may be split into. Standard Mix of Actual Quantity x Standard Price.

The variance is used to focus attention on those overhead costs that vary from expectations. Companies use variance analysis in different ways. Actual Quantity x Standard Rate.

These variances are generally split into two broad categories. To find the overhead burden rate. Indirect manufacturing overhead fixed overheadmachine-hours 115000 42500015000 hours 36machine-hour.

The starting point is the determination of standards against which to compare actual results. Ute the fixed overhead spending and volume variances. Material Cost Variance Formula Standard Cost Actual Cost SQ SP AQ AP Labor Variance Formula Standard Wages Actual Wages SH SP AH AP Variable Overhead Variance Formula Standard Variable Overhead Actual Variable Overhead SR.

Compute And Evaluate Overhead Variances Principles Of Accounting Volume 2 Managerial Accounting

Compute And Evaluate Overhead Variances Principles Of Accounting Volume 2 Managerial Accounting

Variance Analysis Learn How To Calculate And Analyze Variances

0 Comments